Introduction to Noubar Afeyan and Moderna

Noubar Afeyan is a prominent figure in the biotechnology sector, renowned for his role as the co-founder and executive chairman of Moderna, a leading company in the field of mRNA therapeutics. Born in Lebanon and raised in the United States, Afeyan has a diverse background that encompasses science, entrepreneurship, and venture capital. He is the founder of Flagship Pioneering, an innovation firm that has launched numerous transformative companies in biotechnology. His vision for leveraging groundbreaking science, particularly in genetic medicines, has propelled Moderna into a pivotal position within the pharmaceutical landscape.

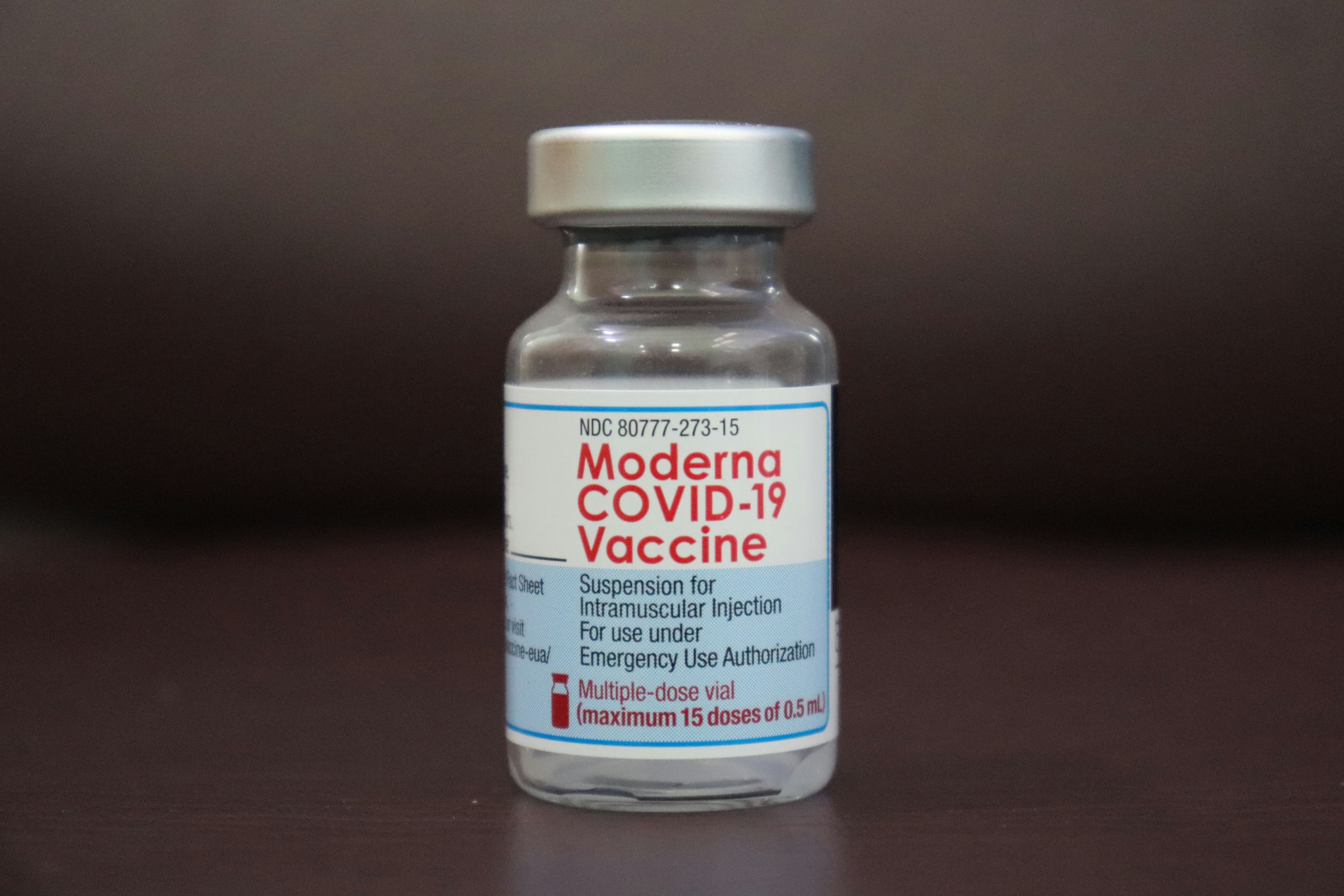

Moderna was established in 2010 with a focus on harnessing messenger RNA (mRNA) technology to develop a new class of treatments and vaccines. This innovative platform enables the body to produce proteins that can trigger an immune response against diseases. The company initially aimed to create a range of therapies for conditions such as cancer and rare genetic disorders. However, its prominence surged dramatically during the COVID-19 pandemic when the urgency for an effective vaccine became paramount. Moderna’s rapid development of its mRNA-based vaccine showcased the potential of this technology, positioning the company as a key player in the global fight against COVID-19.

Throughout its journey, Moderna has received substantial acclaim for its pioneering approach in the biotechnology space, achieving significant milestones that validate its groundbreaking mRNA technology. In 2020, the company’s vaccine received emergency use authorization, leading to high-profile partnerships and considerable financial growth. The success of the vaccine has not only elevated Moderna’s market presence but also underscored the importance of innovation in addressing public health challenges. Understanding Afeyan’s integral role in this success story is essential for grasping the implications of his recent stock sale and its potential impact on Moderna’s future.

Details of the Stock Sale

Noubar Afeyan, the co-founder and chairman of Moderna, recently executed a significant stock sale that raised considerable attention within the investment community. On a designated date this month, Afeyan sold a total of 9,000 shares of the company’s common stock, which resulted in a monetary gain of approximately $703,000. This transaction represents a mere fraction of his overall holdings in the burgeoning biotech firm, where he has been a key figure since its inception.

The timing of this sale coincides with a period of fluctuating stock performance for Moderna, stemming from ongoing developments in the biotechnology sector and vaccine-related news. Such strategic moves by executives can generate speculation among investors regarding their confidence in the company. While the sale may prompt questions about Afeyan’s outlook on Moderna’s future prospects, it is important to recognize that insider selling is typically a common practice among executives. They may sell shares for various reasons, including tax obligations, liquidity needs, or personal financial planning.

Research indicates that executive stock sales do not always signal a negative outlook; in fact, they can frequently be part of a larger financial strategy. Modest stock sales, such as Afeyan’s, often do not reflect a lack of belief in the company’s trajectory. Instead, these transactions are a normal part of corporate life and can occur regardless of the company’s performance or outlook. Nevertheless, investors may remain attentive to such sales, as they can provide insights into the sentiment of company leadership regarding its long-term prospects. Understanding the context surrounding these stock movements is crucial for comprehending their implications in the broader market landscape.

Market Reaction and Implications

The announcement of Noubar Afeyan’s significant stock sale has elicited varied reactions from the market, prompting investors to assess the potential consequences on Moderna’s stock price and overall perception. Immediately following the news, Moderna’s shares experienced a noticeable decline, indicating investor apprehension regarding executive stock transactions. This reaction is not uncommon when high-profile executives sell large quantities of shares, as it can raise questions about the company’s future and the insiders’ confidence in its performance.

The immediate drop in stock price also revealed underlying concerns among shareholders about possible implications for the company’s financial health or strategic direction. Analysts have noted that such sales might be viewed with skepticism, especially in the biotech sector, which has faced significant volatility in recent years. Nonetheless, it is essential to contextualize these transactions within the industry norm. Executive stock sales often occur for various reasons, including personal financial planning, diversification of investment portfolios, or fulfilling tax obligations.

Moreover, the broader trend of executive stock sales in biotech companies highlights a complex relationship between insider transactions and market sentiments. While some may interpret Afeyan’s decision as a negative signal, others argue that prudent financial management among executives can be viewed positively. It becomes critical for investors and analysts to look beyond the sale itself and consider factors such as the company’s performance prospects, pipeline developments, and overall market conditions when assessing the implications of such transactions.

In light of these dynamics, understanding market reactions to stock sales requires a careful analysis of both the immediate reactions and the long-term perspectives on company stability and growth. While concerns may initially arise from these transactions, a balanced approach that reviews the factors at play will provide a clearer view of the implications for investors and shareholders alike.

Future Outlook for Moderna and Afeyan

The future of Moderna appears promising as the company continues to expand its pipeline beyond the initial success with its COVID-19 vaccine. Indeed, Moderna’s commitment to leveraging its mRNA technology for various therapeutic areas signifies its ambition to solidify its position within the biotechnology landscape. Recent developments indicate that the company is exploring vaccines for influenza, cytomegalovirus, and personalized cancer therapies, which may attract considerable interest from investors and healthcare providers alike.

As for Noubar Afeyan, his role as a co-founder and chairman of Moderna is pivotal. His strategic vision and leadership could further shape the company’s initiatives and guide decision-making processes. While his significant stock sale may raise questions, it is essential to interpret this move within the context of a broader strategy that may include diversifying personal investments or reallocating resources to pursue new opportunities. The perception of Afeyan’s financial maneuvering should not overshadow the innovative spirit he has fostered at Moderna.

Additionally, the biotechnology sector is evolving rapidly, requiring leaders like Afeyan to adapt to changes in market demands and regulatory landscapes. His recent actions might be viewed as a signal to investors, highlighting a pragmatic approach to resource management that can benefit Moderna’s long-term goals. As the company pivots toward new developmental projects, the insights and foresight that Afeyan brings will be crucial in navigating future challenges.

In essence, the combination of Moderna’s expanding drug pipeline and Afeyan’s leadership may open doors to groundbreaking medical advancements. Investors and stakeholders will be keenly observing how the company capitalizes on emerging trends and the potential impact of Afeyan’s actions on Moderna’s trajectory moving forward.