Overview of the Share Sale

NVIDIA Executive Vice President (EVP) Shoquist’s recent decision to sell $41.4 million in shares garnered significant attention within the financial community. This transaction involved the sale of approximately 240,000 shares of NVIDIA stock. The sale occurred during a particularly dynamic period for the semiconductor industry, marked by fluctuating stock prices and evolving market conditions. It is noteworthy that the shares were sold at an average price of around $172 per share, which reflects both the company’s strong performance and the investor sentiment prevailing at that time.

The timing of Shoquist’s share sale raises questions among analysts and stakeholders alike. Executives often sell shares for a multitude of reasons, and in this case, it may be attributed to motivations such as diversification of personal investment portfolios, fulfilling liquidity needs, or implementing strategic tax planning measures. Selling shares allows executives like Shoquist to lessen their exposure to any single investment and create a more balanced financial profile. Moreover, it is not uncommon for company leaders to convert a portion of their holdings into cash, particularly when they anticipate potential fluctuations in stock value.

Additionally, the broader economic context plays a pivotal role in such decisions. For instance, recent shifts in market regulations and changes in taxation policies might prompt executives to adjust their positions accordingly. It is essential to note that while a share sale can sometimes raise eyebrows regarding the executive’s confidence in their company’s performance, it does not necessarily indicate a lack of belief in the firm’s future prospects. Rather, it can be viewed as a strategic move in the context of personal financial management. Understanding these nuances can provide deeper insights into the implications of Shoquist’s stock sale and the potential ripple effects on investor sentiment moving forward.

NVIDIA’s Current Market Position

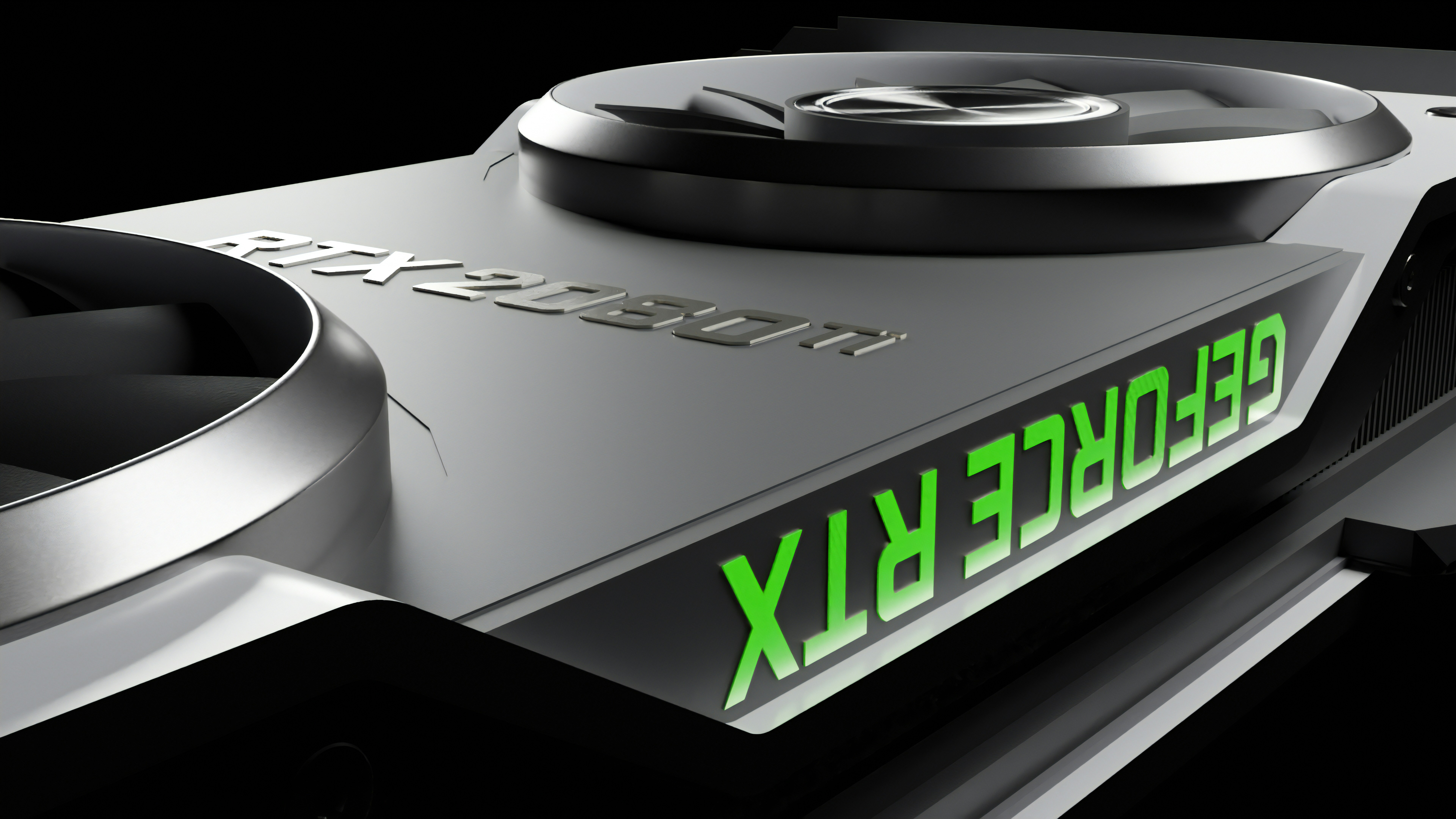

NVIDIA Corporation has established itself as a dominant player in the semiconductor and technology sectors, particularly within graphics processing units (GPUs) and artificial intelligence (AI) markets. As of the latest financial quarter, NVIDIA reported revenue growth of approximately 50% year-on-year, driven primarily by robust demand for its GPUs used in gaming, data centers, and AI applications. The company’s commitment to innovation is evident in its substantial investments in research and development, which amounted to nearly 20% of its revenue in the previous fiscal year.

Market analysts have noted a shift in consumer trends, with an increasing preference for AI-powered applications. This trend has positioned NVIDIA favorably, as they continue to leverage their leadership in GPU technology to cater to this emerging demand. Moreover, their recent product launches, including advanced GPU architectures designed for superior performance in deep learning and data processing tasks, have received significant acclaim in the tech community. This aligns with NVIDIA’s strategic focus on enhancing its AI capabilities, as well as expanding into new markets such as automotive technology.

While the market sentiment around NVIDIA remains primarily bullish, it is essential to consider the competitive pressures the company faces. Rival firms are making significant strides in GPU technology, and the overall semiconductor market is experiencing volatility due to geopolitical tensions and supply chain challenges. The recent sell-off of shares by NVIDIA’s Executive Vice President, Debora Shoquist, may have raised questions among investors regarding insider confidence. However, it is worth noting that insider sales can often be based on financial planning rather than a reflection of the company’s future prospects.

In the current landscape, NVIDIA stands as a pivotal entity, continually adapting to market dynamics and maintaining a strong trajectory towards sustained growth.

Executive Stock Sales: What They Mean for Investors

Executive stock sales, such as the recent $41.4 million divestiture by NVIDIA’s Executive Vice President, Debra Shoquist, can evoke various reactions among current and prospective investors. Insider selling is often scrutinized, and opinions regarding its implications can be polarizing. Some investors interpret such actions as a lack of confidence in the company, while others view them as a normal part of executive financial management.

It is essential to understand that executives often sell shares for several reasons unrelated to the company’s performance. Common motivations include personal financial planning, diversifying investments, or fulfilling tax obligations. Therefore, it is crucial for investors to avoid jumping to conclusions based on a single event. Historical data on insider transactions can offer valuable context; numerous studies indicate that not all insider sales correlate with negative stock performance. For instance, research has shown that while some stock dips follow significant executive sell-offs, others have proven to be short-lived or superficial.

Investors should also consider the broader market conditions and the company’s fundamentals when interpreting insider sales. An executive’s decision to sell shares should be analyzed alongside other indicators, such as revenue growth, market trends, and overall industry health. This multi-faceted approach allows investors to assess whether they should be concerned or if the sale is inconsequential in the grander scheme.

As a best practice, maintaining a diversified investment portfolio can mitigate the potential risks associated with individual stock performance. Consequently, informational transparency from companies regarding insider transactions and a broader understanding of the motivations behind these sales can assist investors in making informed decisions. By considering these factors, investors can place executive stock sales within the context of their long-term strategies.

Future Outlook for NVIDIA and Investor Sentiment

The recent sale of shares by NVIDIA’s Executive Vice President, Debora Shoquist, for a significant sum of $41.4 million, raises pertinent questions about the future trajectory of the company. Such executive actions can be viewed as indicators of confidence—or lack thereof—in a company’s prospects. Investors often assess the implications of insider trading, considering whether these moves signal a potential downturn or reflect strategic planning for future growth. While insiders may sell shares for various reasons, including personal financial needs or diversification of investments, the timing of such sales can influence market perceptions significantly.

Looking towards the future, NVIDIA operates in a rapidly evolving industry, characterized by advancements in artificial intelligence, machine learning, and high-performance computing. As demand for GPUs continues to surge, particularly in the gaming and data center sectors, investor sentiment remains cautiously optimistic. Many investors are aware of the high volatility associated with tech stocks and potential fluctuations in revenue; however, the company’s strategic initiatives, such as partnerships and research developments, may offset concerns stemming from insider sales.

Market analysts predict that NVIDIA’s stock price could remain robust due to its positioning in key growth areas. The anticipated launch of new product lines and the expanding applications for its technology across various industries further bolster projections for continued revenue growth. Moreover, prevailing market trends suggest an increasing reliance on AI technologies, potentially enhancing NVIDIA’s stock appeal among investors in the coming quarters.

Ultimately, while Shoquist’s share sale may evoke questions regarding executive sentiment, it does not inherently dictate the company’s future performance. Instead, investors must consider broader market dynamics, industry innovations, and long-term growth strategies that NVIDIA has implemented. A balanced perspective on these factors will be crucial for informed investment decisions moving forward.