Overview of Agilent Technologies

Agilent Technologies, a global leader in life sciences, diagnostics, and applied chemical markets, plays a pivotal role in advancing scientific discovery and improving human health. Established in 1999 as a spin-off from Hewlett-Packard, Agilent has evolved into a robust entity, offering a wide range of instruments, software, services, and consumables that support researchers and laboratories worldwide. The company operates through several segments, including Life Sciences, Diagnostics, and Applied Markets, each contributing to its leading position in various critical fields.

In the life sciences sector, Agilent is recognized for its innovative solutions that enhance genomic research, proteomics, and drug development. Their advanced analytical instruments, such as mass spectrometers and chromatography systems, are integral for scientists and researchers in both academic and commercial settings. Furthermore, Agilent’s commitment to quality and innovation has solidified its position in diagnostics, where its technologies provide essential support to laboratories in identifying and monitoring diseases effectively.

Market performance trends indicate that Agilent Technologies continues to show robust growth, bolstered by steady demand for biopharmaceutical and diagnostics tools. The company has made significant investments in research and development, which underscores its dedication to innovation. Recent financial reports reflect a favorable trajectory, with increased revenue attributed to its expanding portfolio and collaboration with various industry partners. Such growth is critical for attracting investors who seek opportunities within the scientific and technological sectors.

Overall, Agilent Technologies not only reinforces its reputation as a market leader through continuous innovation and strategic investments but also plays a crucial role in addressing global health challenges. This context is essential for understanding the implications of stock transactions, such as the recent sale by Director Brown.

Details of the Stock Sale by Director Brown

On a date not specified, Director Brown of Agilent Technologies executed a notable transaction involving the sale of shares amounting to $904. The transaction involved the sale of a specific number of shares, reflecting a calculated decision in response to prevailing market conditions. Such a sale, albeit modest in financial terms, can pique the interest of investors who closely monitor the activities of corporate directors and executives.

The context of the transaction is vital; it occurred in a market environment where investors were assessing various factors influencing stock valuations. While $904 may appear as a minor figure in the grand scheme of stock trading, the implications of a director selling shares can be significant. Securities regulations require directors to disclose changes in their holdings, thereby enhancing transparency within the stock market. Typically, these disclosures provide investors with insights into the management’s confidence in the company’s future performance.

There is often a misconception that insider sales universally imply negative sentiments about a company’s prospects. However, it is critical to evaluate the circumstances surrounding the sale. For instance, directors may sell shares for various reasons, including personal financial planning, fulfilling tax obligations, or diversifying their investment portfolios. Consequently, it is essential for investors to discern whether the sale is indicative of a larger trend or merely a personal financial decision. Investors should consider analyzing Agilent Technologies’ performance indicators and market behavior in conjunction with the stock sale to gauge its potential impact effectively.

Ultimately, while the specifics of Director Brown’s stock sale cannot on their own paint a complete picture of Agilent Technologies’ trajectory, they serve as one of many pieces of information that investors should weigh when analyzing the company’s outlook.

Market Reactions and Investor Implications

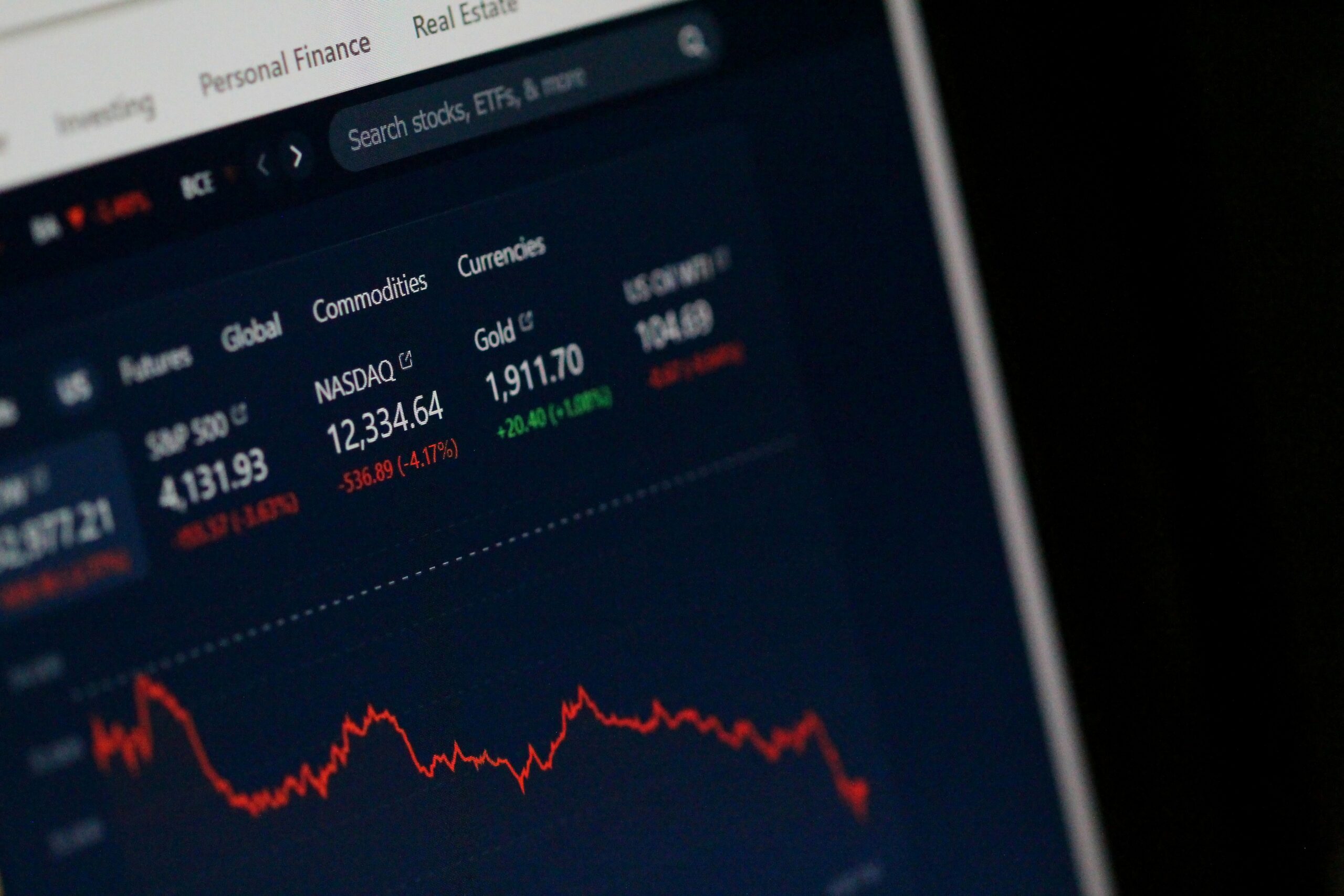

The recent announcement of Director Brown’s sale of $904 in Agilent Technologies stock elicited a notable response from the financial markets. Typically, transactions executed by company insiders can provoke a range of reactions among investors, especially regarding potential implications for the company’s future performance. Following the disclosure of this trade, Agilent Technologies experienced fluctuations in its stock price, reflecting the sentiment of investors and market analysts alike.

On the day of the announcement, the stock price exhibited a modest decline, a pattern that is not uncommon when insider sales occur. Investors often interpret such sales as a lack of confidence from company executives, which can instigate selling pressure among other shareholders. However, it is essential to consider the broader market trends and the context surrounding insider transactions. In many cases, insiders sell for various reasons, such as personal financial needs or diversification of their investment portfolios, which may not directly correlate with the company’s operational health.

The implications for existing shareholders are significant. While some may view the stock sale as a potential red flag, indicating that insiders foresee challenges ahead, others might argue that such sales should be examined in the context of the insider’s overall financial strategy. Increased scrutiny of insider trading can lead to shifts in investor sentiment, impacting future investment decisions. Analysts suggest that investors should remain vigilant, monitoring for further insider trading activity and evaluating the company’s financial performance and strategic direction before acting on their fears about this recent transaction.

Overall, while Director Brown’s stock sale may appear concerning at first glance, it is crucial for investors to contextualize this event within the broader landscape of Agilent Technologies’ operational performance and market dynamics.

Conclusion: What Does This Mean for Agilent Technologies Going Forward?

The recent stock sale by Director Brown at Agilent Technologies, amounting to $904, prompts a critical examination of the company’s future prospects. Although the amount may appear relatively modest within the context of Agilent’s overall market capitalization, it raises pertinent questions about the strategic direction and near-term challenges for the company. Understanding the implications of such transactions can provide investors with a clearer view of potential risks and opportunities in the market.

From an investor’s perspective, the sale may signal confidence in the liquidity of Agilent’s shares or an adjustment to personal financial strategies rather than a catastrophic outlook for the company. It is crucial to recognize that stock sales by executives do not inherently reflect adverse conditions; often, they can occur for a variety of personal financial reasons. However, it is also important for stakeholders to remain vigilant about broader market trends that could impact the company’s operational performance and share value.

Looking forward, Agilent Technologies will likely face several challenges, including intensified competition within the biotechnology and diagnostics sectors. Companies operating in these domains must continuously innovate to maintain market leadership. Conversely, the increasing demand for precision medicine and advanced analytical tools presents substantial growth opportunities for Agilent. As technological developments unfold, the company can capitalize on these trends to enhance its portfolio and drive revenue growth.

In conclusion, while the sale by Director Brown may raise some eyebrows, it is crucial to assess it within the broader context of Agilent’s strategic objectives and market conditions. The next few months will be pivotal for Agilent as it navigates potential hurdles while simultaneously leveraging new growth avenues. Investors should approach the situation with a balanced outlook, considering both the risks and opportunities that lie ahead, ensuring an informed investment strategy in an ever-evolving market landscape.